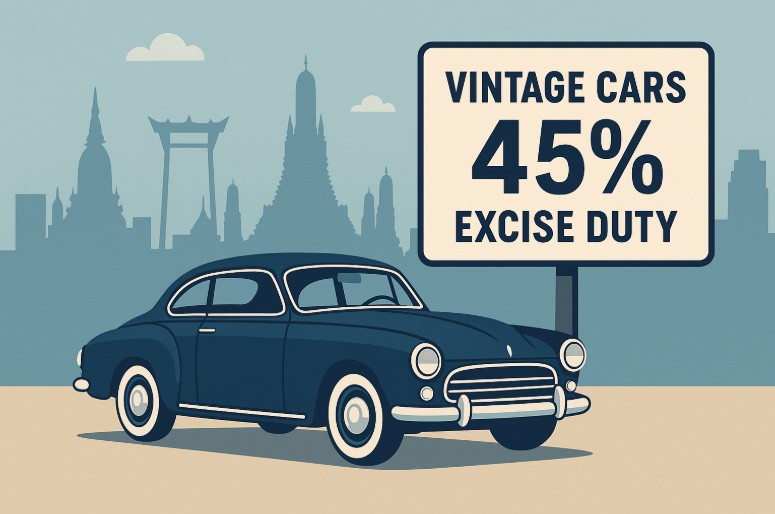

Vintage Car Import to Thailand:

Excise Duty Drops to 45%

What Expats Need to Know

Good News for Expats Moving to Thailand with Classic Cars

Planning your move to Thailand? A groundbreaking new law just changed everything for classic car enthusiasts. Starting in fiscal year 2026, Thailand’s government will significantly reduce the excise duty on imported vintage cars—from over 200% to just 45%. If you’re planning on relocating to Bangkok, Chiang Mai, or Phuket and want to bring your beloved classic car, this is your moment.

Moving to Bangkok? Here’s Why It Matters

1. Importing Is Now Financially Feasible

About your project to move to bangkok or anywhere else in the Kingdom, staying informed about Thailand’s evolving customs and excise regulations is essential. The Thai Excise Department recently announced a landmark policy shift that directly impacts anyone considering importing a classic or vintage automobile as part of their relocation.

For expats who’ve dreamed of bringing their prized vintage vehicle to Thailand, this represents the most significant regulatory change in decades—and potentially transforms what was once prohibitively expensive into a realistic option.

The new 45% rate, while not negligible, opens the door for collectors and expats who previously couldn’t afford to bring in their cars. With careful budgeting and professional relocation support, it’s now a realistic option.

2. Import Costs Are Now Predictable (Though Still Substantial)

While a 45% excise duty remains a significant expense, it’s dramatically more reasonable than the previous 200%+ rates that effectively functioned as an import ban. For vintage car collectors with substantial emotional or financial investment in their vehicles, this makes importation feasible with proper budgeting.

Important context: Thailand imposed comprehensive restrictions on importing personal vehicles in 2019, closing what had been a limited pathway for expats. This new vintage car provision represents the first meaningful exception to that ban, creating a specialized import category for classic automobiles.

3. Weekend-Only Usage Requires Lifestyle Adjustment

Your vintage car will not be eligible for weekday use unless you obtain special permission. Consider:

Maintaining a second modern car for daily commuting

Applying for usage extensions (if eligible)

Keeping your classic car as a recreational or event-only vehicle

4. Expert Assistance Is Essential

The import process is complex. From valuation reports to customs documentation, a reliable partner like Asia Relocation Thailand makes all the difference.

We help with:

Customs clearance

Shipping coordination

Excise tax assessment

Local permit applications

🧳 Checklist: Importing a Vintage Car to Thailand

| 🧩 Step | ✅ To-Do |

|---|---|

| Eligibility | Confirm your car is 30+ years old |

| Budgeting | Account for excise tax, shipping, insurance, etc. |

| Weekend-Use Compliance | Understand usage limitations |

| Special Permits | Explore options for weekday exemptions |

| Relocation Partner | Contact Asia Relocation Thailand 3–6 months ahead |

| Back-up Vehicle | Plan for weekday transportation |

Thailand’s new vintage car import policy introduces several key provisions:

The New Tax Structure:

- Revised excise duty: Beginning in fiscal year 2026, imported vintage cars (defined as vehicles 30+ years old) will face a 45% excise duty rate

- Previous situation: Thailand effectively banned personal vehicle imports since 2019, with prohibitive tax rates exceeding 200% that made imports virtually impossible

- Grandfathered vehicles: Classic cars and motorcycles already registered in Thailand before the law’s implementation remain unaffected

- Usage restrictions: Imported vintage vehicles can only be driven on weekends and public holidays, unless special permission is granted through formal application

Policy Objectives:

According to the Thai Excise Department, this reform aims to generate substantial revenue (estimated at 1–2 billion THB annually), position Thailand as a regional hub for vintage car exhibitions and collector events, and stimulate the domestic classic car restoration industry. The policy reflects Thailand’s broader strategy to attract high-value tourism and position itself as Southeast Asia’s premier destination for automotive enthusiasts.

🏛️ BOI Thailand and Vehicle Imports

For corporate relocations and business-related moves, Thailand’s Board of Investment (BOI) offers special privileges that may include vehicle import allowances. Companies establishing regional operations under BOI promotion schemes should investigate whether their investment category includes vehicle import provisions.

Expats relocating under corporate sponsorship should work with their employers and professional relocation specialists to understand whether BOI benefits apply to their situation.

Resources for Expats Bringing Cars to Thailand

📣 Ready to Make the Move?

Planning your relocation to Thailand is exciting—but details like vehicle import rules can have a big impact on your move. With the excise duty on vintage cars now at 45% instead of 200%, opportunities have opened up for collectors and enthusiasts.

To make sure your move goes smoothly, partner with an experienced Thailand moving company like Asia Relocation Thailand. From household goods to vehicle imports, professional movers can simplify customs clearance and ensure compliance with Thailand’s latest regulations.